Contents

There are many types of financial instruments that can be used for swing trading. The choice of an instrument depends on the trader’s risk profile, level of experience and present market conditions. Previously, Salesforce was not among the best choices for swing traders. However, the company has found a way to impress everyone concerned with moves like the Slack takeover (the $27.7 billion deal) and the COVID-19 “Vaccine Cloud”. These have drawn traders’ attention towards Salesforce, making it an attractive swing trade option. This, in its turn, has affected earnings for corporations like Microsoft.

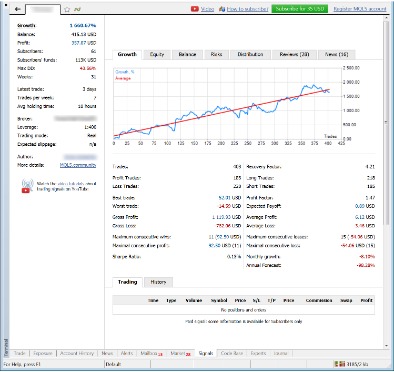

It will also help you determine the risk and reward you are looking to employ with your swing strategy. Prior to risking your capital you should paper trade or use a demonstration account. A demo account allows you to trade in real-time using your strategy to see if it works. There will be times when you back-test a strategy works but is unsuccess when tested in real-time.

However, if you are confident in continual appreciation of the https://topforexnews.org/s, you may be able to multiply your position through leverage. It’s often said that bad trading habits are formed during bull markets. Continue to do due diligence and market research on the best securities to hold; while it may seem like every security is a winner, this won’t always be the case. Instead of buying now and selling later, the ideal position to hold if you believe prices are declining is to sell a security first, then buy it back later. This means that if the trader is approved for margin trading, they only need to put up $25,000 in capital for a trade with a current value of $50,000, for example.

To swing trade effectively, it is important to identify an asset that is trending strongly, but within a plotted channel. Swing trading is a versatile strategy that can be applied in a variety of markets. A swing trading strategy video provided valuable visual demonstrations of how to trade the strategy. So far our favorite swing trading indicator has correctly predicted this sell-off, but we’re going to use a very simple candlestick based method for our entry trigger. For entry, we want to see a big bold bearish candle that breaks below the middle Bollinger Band.

When swing trading on our platform, traders are required to trade using margin, also referred to as leverage. This means that you only need to deposit a percentage of the full value of the trade to open a position and gain exposure to the financial markets. The margin requirement will vary depending on the asset that you want to trade, but can start from as little as 3.3%.

Swing trading is an effective strategy for rising, falling, and sideways moving markets — as long as the price movement is large enough to generate a useful swing. Wyckoff Method expert and Golden Gate University Adjunct Professor Roman Bogomazov will be presentinga two-part online workshop on Swing Trading Using the Wyckoff Method. Though this approach to the markets works well in any time frame, it’s ideally suited to swing trading in harmony with market turns. Add promising prospects in cloud computing, and you will get appealing stocks to swing trade. AMD managed to bring itself back into the game when the company focuses on something it does best.

Bull Market Swing Trading

Investments in stocks, options, ETFs and other instruments are subject to risks, including possible loss of the amount invested. The value of investments may fluctuate and as a result, clients may lose the value of their investment. Past performance should not be viewed as an indicator of future results.

By checking these https://forex-trend.net/ indicators, traders search for securities with impulsive price movements and look for the best entry point when opening positions. This type of trader does not particularly consider the long-term value of a given stock. The last benefit of using a simple swing trading strategy is that you won’t need to be glued to the screen for the whole day like with day trading strategies. A swing trading plan will work in all markets starting from stocks, commodities, Forex currencies, and much more.

https://en.forexbrokerslist.site/ traders identify a possible trend and then hold the trade for a period of time, from a minimum of two days to several weeks. Swing trading is an easy way for new traders to get their feet wet in the market, with traders typically starting with $5k-$10k, although less is acceptable. The cardinal rule though is that this capital should be money the investor can afford to lose. Even with the strictest risk management, the unexpected is always possible. Swing traders leverage technical analysis to determine entry and exit points. Learn how to read stock charts and analyze trading chart patterns, including spotting trends, identifying support and resistance, and recognizing market reversals and breakout patterns.

Check out Benzinga’s guides to thebest swing trading courses,best online brokerages,free stock tradingandbest stocks under $5. Swing trading and long-term investing are completely different animals, so you’ll need a broker that fits your needs. Swing traders should look for brokers with $0 commission or discounts on high-volume trading. The company offers customer relationship management technology that brings companies and customers together. Learning swing trading is an ongoing process that should never stop. The free resources we have here in the VectorVest blog are great, but investing in higher learning is a great way to ensure success with swing trading.

Last year, the company made a 12% revenue growth along with a 40% boost in its net income. Given that social media is one of the pillars of modern life , Facebook is a perfect go-to stock for swing trading. Swing trading strategy FAQs include questions about how to identify the right indicators to use, how to set stop-loss orders, and how to manage risk in volatile markets.

Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success.

Swing Trading Dividend Stocks: A Comprehensive Guide to Outperforming the Market

If you’re new to technical analysis, you might want to review the basics. While the principles behind swing trading are simple, consistently executing a winning strategy over the course of a year is not easy. But after we discuss the average swing traders’ success rate, we’ll talk about what you can do to increase your chances of making consistent profits through this style of trading.

At the end of the day, the only way to ensure a trading system will reflect your own personality and trading style is to develop it yourself. To that end, this site is organized around the key components of any successful swing trading system. You can find a list of Benzinga’s recommendations for swing trade stocks above. Holding the position for a longer period of time may result in larger profits, but it can also result in larger losses, due to the use of leverage. Day traders often need to be able to remain calm and stay focused on their screens for hours each day, which is less important for swing trading as the process happens at a slower pace. As a trader, you can choose between a variety of trading strategies.

Swing trading sits in the middle of the continuum between day trading to trend trading. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans. Swing trading exposes a trader to overnight and weekend risk, where the price could gap and open the following session at a substantially different price. A trader can measure their performance as a percentage of the trading channel width. The perfect trade would be buying at the bottom channel line and selling at the top channel line, which would be a 100% performance.

What instruments do swing traders typically trade?

In addition, it’s advised to understand simple moving averages and trading channels to properly set up your early trades. Ultimately, each swing trader devises a plan and strategy that gives them an edge over many trades. This involves looking for trade setups that tend to lead to predictable movements in the asset’s price. With a favorable risk/reward, winning every time isn’t required. The more favorable the risk/reward of a trading strategy, the fewer times it needs to win in order to produce an overall profit over many trades. Swing traders primarily use technical analysis, due to the short-term nature of the trades.

- Some abrupt reversals in the market can cause a substantial loss because you don’t trade the whole day.

- You can also use the ZigZag to identify support and resistance levels.

- Swing traders often enter into a position, hold for days to weeks, then exit their position with having hopefully taken profits.

- Whereas swing trading aims to capture the up-swings and down-swings in price for a short period of time, often for a number of days or weeks, position trading involves a longer timeframe.

Swing traders are exposed to gap risk, where a security’s price changes while the market is closed. Learn how to interpret a stock chart to understand the movement of the stock market and an individual stock’s performance, as well as how to make sound financial decisions. The right combination is different for every trader, so it’s important to start with the basics and work your way into using the indicators and patterns that make the most sense to you.

Reasons Why This Time frame is Best for Swing Trading! (Which Chart Is Better?)

It is often employed by institutional investors, who tend to hold their assets for many years. These investors look to ride the asset price’s ups and downs, only cashing out when the asset’s value has reached an advanced or mature stage, having risen significantly. This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy.

Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. An exit point is the price at which a trader closes their long or short position to realize a profit or loss. Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Aside from a risk/reward, the trader could also utilize other exit methods, such as waiting for the price to make a new low. With this method, an exit signal wasn’t given until $216.46, when the price dropped below the prior pullback low.

In most cases, traders will depend on Technical Analysis, using historical data and price charts to determine asset-management actions. That is a more comfortable option and does not require a massive amount of work from the trader. In the traditional sense, swing trading is a speculative trading strategy used by traders in different markets and various assets. The trader will hold the tradeable asset for anywhere between a few days to up to a few weeks.

Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost. Many or all of the offers on this site are from companies from which Insider receives compensation . Advertising considerations may impact how and where products appear on this site but do not affect any editorial decisions, such as which products we write about and how we evaluate them. Swing trading can be incredibly lucrative and fun when executed with a proper strategy and ruleset. A ZigZag feature allows you to enter a percent feature and it will show you all the price changes that qualify for your criteria.